In Quickbooks, Billable Expense Income refers to expenses that can be reimbursed by a client. It helps track client-related expenses for accurate invoicing.

Billable Expense Income in Quickbooks plays a crucial role in maintaining financial transparency and ensuring clients are properly billed for expenses incurred on their behalf. By categorizing and recording these expenses correctly, businesses can streamline their billing processes and accurately track reimbursable costs.

Understanding how to handle Billable Expense Income within Quickbooks is essential for businesses looking to maintain accurate financial records and provide transparent invoicing to clients. In this guide, we will delve into the concept of Billable Expense Income in Quickbooks, how to properly record and track these expenses, and the benefits of effectively utilizing this feature in your accounting processes.

Credit: quickbooks.intuit.com

What Are Billable Expenses?

Billable expenses in Quickbooks refer to the costs that a business incurs on behalf of a client or customer, with the intention of being reimbursed for those expenses. These expenses can be passed on to the client or customer in the form of a billable charge, allowing the business to recover the costs incurred.

Definition

Billable expenses in Quickbooks are costs that a business incurs on behalf of a client or customer, with the intention of being reimbursed, and are later billed to the client or customer in the form of a billable charge.

Examples

Here are some examples of billable expenses:

- Purchasing materials for a project on behalf of a client

- Travel expenses related to client meetings

- Outsourced services charged to a specific client

Credit: quickbooks.intuit.com

How To Track Billable Expenses In Quickbooks

Are you using QuickBooks and need to track billable expenses efficiently? Learn how to manage Billable Expense Income in QuickBooks with ease by following these simple steps.

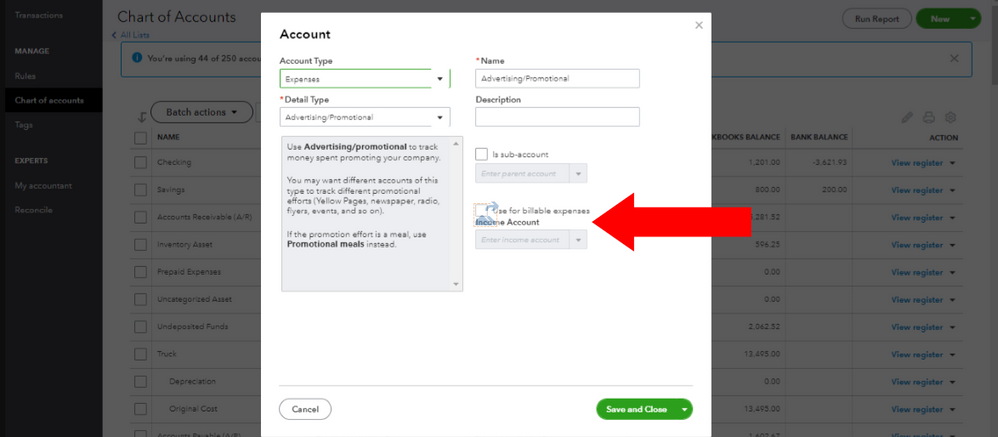

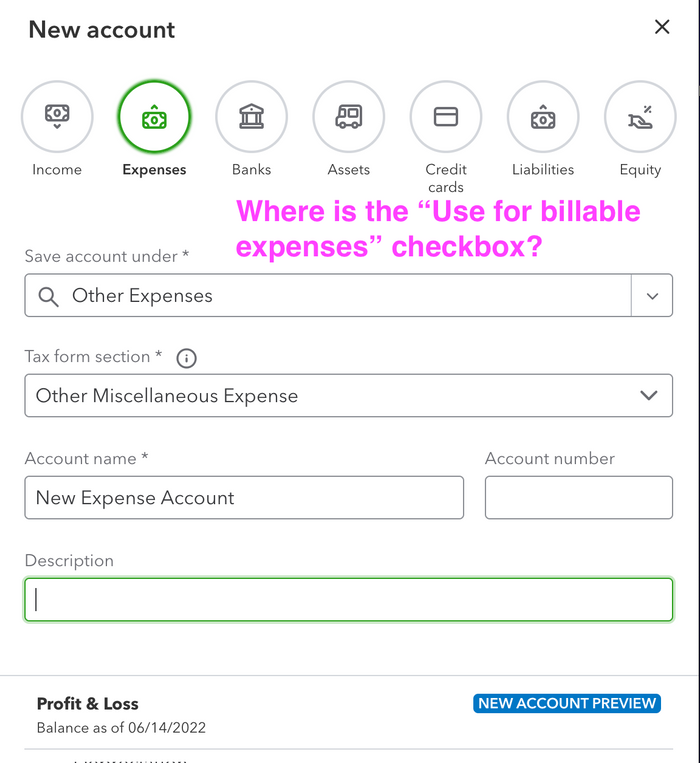

Enabling Billable Expenses

To start tracking billable expenses, you need to enable this feature in your QuickBooks settings.

Entering Billable Expenses

When adding a new expense, ensure to mark it as billable to a customer, categorize it correctly, and link it to an expense account.

Assigning Billable Expenses To Customers

After entering billable expenses, assign each one to the respective customer by selecting them from the drop-down menu.

Generating Invoices For Billable Expenses

Create a customized template for your invoices in QuickBooks to reflect your branding.

Include billable expenses such as materials or services used in a project on the invoice.

Once the invoice is ready, send it to the customer through QuickBooks for prompt payment.

Credit: quickbooks.intuit.com

Tracking And Recording Billable Expense Income

Tracking and Recording Billable Expense Income in QuickBooks is an important aspect of managing your business finances effectively. It involves the process of monitoring and documenting expenses incurred on behalf of a client and then billing them back for those expenses. Proper tracking and recording ensure accurate financial reporting and help in keeping the cash flow healthy.

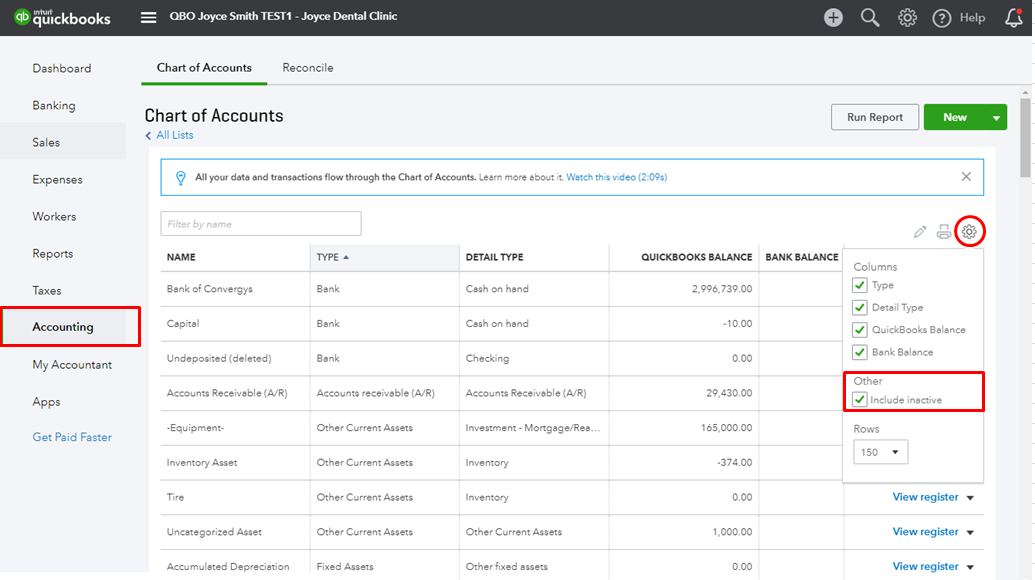

Viewing Billable Expense Income Reports

One of the key functionalities of QuickBooks is its ability to generate in-depth reports that provide insights into billable expenses and income. To view billable expense income reports in QuickBooks, you can navigate to the ‘Reports’ tab, select ‘Sales and Customers’, and then click on ‘Sales by Customer Detail’ report. This report will display a breakdown of all billable expenses and their associated income, allowing you to track the profitability of each client.

Recording Billable Expense Income

Recording billable expenses in QuickBooks involves categorizing expenses as billable to a customer or project. This is done by selecting the ‘Billable’ checkbox when entering the expense in the expense transaction form. Once the expense is marked as billable, QuickBooks will prompt you to select the customer or project that the expense should be billed to. This ensures that the expenses are accurately reflected in the customer’s invoice.

Tips For Managing Billable Expenses In Quickbooks

Learn how to effectively manage billable expenses in QuickBooks with these helpful tips. Keep track of your billable income easily and efficiently using this popular accounting software.

Setting Reminders For Unbilled Expenses

One of the key aspects of efficiently managing billable expenses in QuickBooks is to ensure that you don’t miss out on any unbilled expenses. It’s crucial to promptly record and invoice these expenses to avoid any loss in revenue. To help you stay on top of your billable expenses, QuickBooks provides a useful feature: setting reminders.

Reminders act as friendly prompts, nudging you to review and bill any outstanding expenses. By setting reminders, you can make sure that no unbilled expenses slip through the cracks. Here’s how you can set reminders for unbilled expenses in QuickBooks:

- Login to your QuickBooks account and navigate to the Homepage.

- Click on the Gear icon located at the top right corner of the screen.

- Select “Account and Settings” from the drop-down menu.

- In the left-hand menu, click on “Expenses”.

- Scroll down to the “Bills and expenses” section.

- Check the box that says “Remind me to bill for unbilled expenses”.

- Set the frequency for reminders that suits your needs.

- Click “Save” to apply the changes.

Reviewing Unbilled Expenses Regularly

While setting reminders is a great step towards managing billable expenses, it’s equally important to regularly review and reconcile any unbilled expenses. By staying diligent in this process, you can ensure that all billable expenses are recorded accurately and billed to your clients promptly. Here are some tips to help you review unbilled expenses in QuickBooks:

- On a weekly or monthly basis, navigate to the “Expenses” tab in QuickBooks.

- Click on “Expenses” and then select “Unbilled expenses”.

- A list of all unbilled expenses will be displayed.

- Take the time to go through each expense, ensuring that it is billable to a specific client.

- Make any necessary adjustments, such as adding client details or changing the expense category.

- Once you have reviewed and modified all unbilled expenses, you can create an invoice directly from QuickBooks.

- Double-check the invoice to ensure accuracy, and then send it to your client.

By following these tips for managing billable expenses in QuickBooks, you can streamline your billing process and improve your financial efficiency. Don’t forget to set reminders for unbilled expenses and review them regularly to make sure you capture every billable item. With QuickBooks as your ally, you can stay on top of your finances and make the most of your billable expense income.

Frequently Asked Questions On Billable Expense Income Quickbooks

What Is A Billable Expense Income On Quickbooks?

Billable expenses income on QuickBooks refers to costs incurred on behalf of a client, which can be billed back to them. It helps track project expenses and ensures accurate reimbursement. Properly categorizing and recording these expenses can streamline billing and improve financial visibility.

How Do I Record Billable Expenses In Quickbooks?

To record billable expenses in QuickBooks, go to Expenses > New Transaction > Billable Expense > Enter details.

What Is Billable Expense Income 27?

Billable expense income 27 refers to the revenue generated from charges passed on to clients for incurred expenses.

What Type Of Account Are Billable Expenses?

Billable expenses are typically linked to a specific client or project. They are often associated with customer invoices and are considered a part of your revenue.

Conclusion

Managing billable expenses in QuickBooks is crucial for accurate income tracking. With the right process in place, businesses can ensure proper invoicing and financial transparency. By following the recommended steps and utilizing QuickBooks efficiently, businesses can streamline their billing process and achieve better financial control.